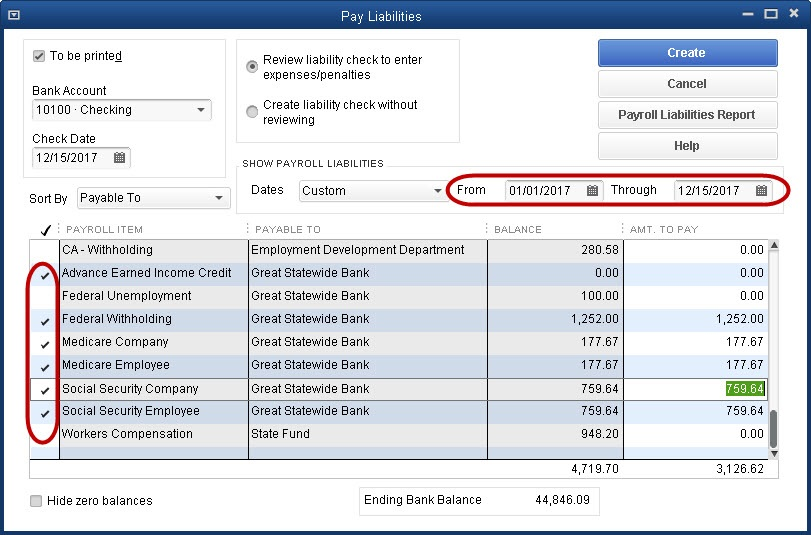

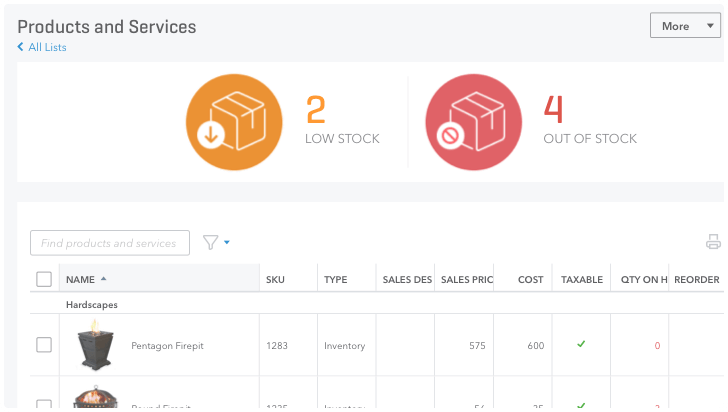

The cost is pretty reasonable, in the range of $79/mo. With this solution, Payroll is processed inside of QuickBooks and after each processing is sent electronically to QuickBooks Payroll Service, who takes care of remitting the payroll taxes and filing the reports. Extrapolating job-costing information from outside payroll services reports accurately is difficult at best and impossible without sophisticated spreadsheets for every job.įortunately, QuickBooks does offer a solution called QuickBooks Assisted Payroll. QuickBooks integrated payroll is the best way to extract comprehensive job-costing information. For Contractors and other Professionals who use Job-costing, it is not always the easiest choice. If you know a payroll service is handling the taxes and reports, you can avoid a situation like this. This employer really thought his bookkeeper was “taking care of everything”. One of his employees ended up owing the IRS hundreds of dollars, and Patrick owed thousands. His bookkeeper had provided his employees with incorrect W-2’s, which we discovered while unraveling the terrible bookkeeping. In a more dramatic instance, Patrick, an Electrical Contractor, came to me with an even worse situation. Jonathan knew something was up, but he really had no idea that his payroll taxes were so far behind.

I discovered that not only had she not entered all of his banking transactions or reconciled his bank account for the entire year, but she had not paid his payroll taxes for 3 months, or filed his quarterly reports. His well-paid bookkeeper just stopped showing up, and he needed help. In some cases, these surprised employers owed a considerable amount of penalties and interest, in additon to liabilities they thought were paid!įor instance, last November I was hired by a General Contractor named Jonathan. Unfortunately, the employer is ulitmately responsible. I have personally known a few Employers who have gotten burned because the person responsible for paying the payroll taxes and filing the reports did not do the job.

Many employers are more comfortable with this arrangement. Many businesses prefer to use an outside payroll service for the peace of mind provided by someone else taking responsibility for the Payroll Reports and Tax Payments. Perfect Payroll Option for Job-Costing in QuickBooks – Assisted Payroll

0 kommentar(er)

0 kommentar(er)